Our Solutions

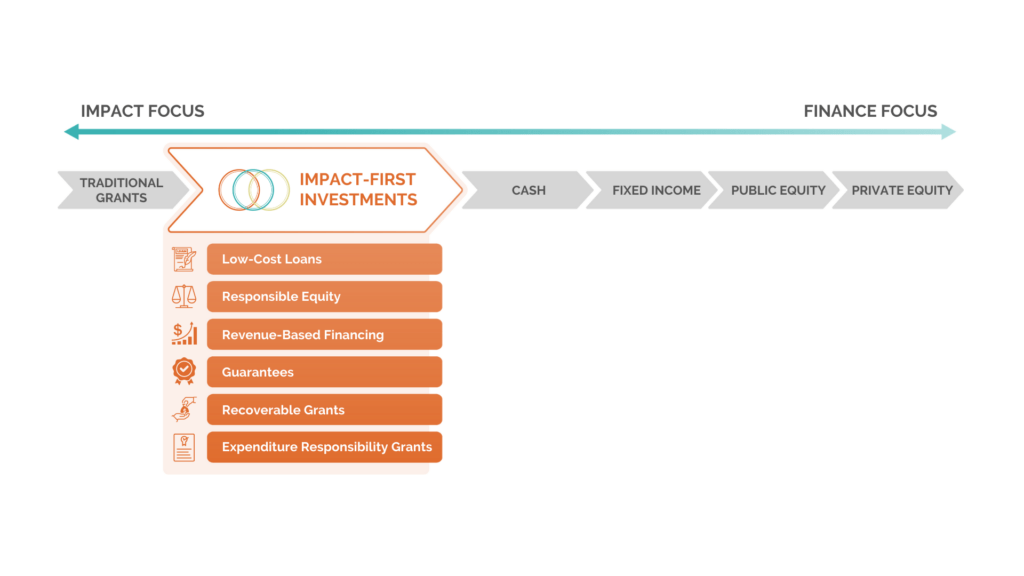

Impact-First Investments

Within impact-first investing,

our investment, transaction services cut across all that we do.

Executive Overview

As an Impact Capital Catalyst, Impact Charitable unlocks and accelerates capital that sparks positive change.

We move more money, in more ways, to more people and places.

And we do this through Impact-First Investing. Our focus is first and foremost on impact, and we balance the financial return and risk relative to this impact. We understand the need for non-traditional investment structures, and the accompanying due diligence to make prudent investments. While we fully expect to see financial returns on investments from our Funds, we function as an impact-first investor, focusing on the impact and outcomes from investments over the level of financial return.

We are not a parking lot for funds.

We are not just a grantmaker, either—although we love grants and we help our investors make them all the time. Instead, our bread and butter at Impact Charitable is the more innovative stuff—the newer thinking, the out-of-the-box problem solving, the higher risk and higher reward. DAFs are a conventional philanthropic tool, but they do not have to be used conventionally.

We work with investors

We work with investors who realize that all the traditional approaches in the world may not be enough to achieve the just, equitable outcomes we want. Impact Charitable has extensive impact-first investing experience, combining the expertise of our staff in philanthropy and finance to help people move money directly into impactful organizations to make lasting change.

Product Overview

We are ready to be a resource for you

Through our full range of transaction support services including due diligence, transaction structuring & execution (legal), investment management and reporting, we can help with:

Direct Investments

Direct, philanthropic investments into ventures, project, funds

Program-Related Investment Services

Transaction support, facilitation, capital aggregation

Philanthropic Investment Funds

Create and manage specific thematic investment funds

Transaction Services

• custom application development

• due diligence

• legal documentation

• investment management

• impact reporting

Source direct impact investments into for-profits, nonprofits, ventures and funds

Bring together like-minded funders for pooled investments

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia dese.

• Source investments and provide transaction services to complete direct impact investments into for-profit, nonprofit ventures and funds.

• Create community-driven special purpose “thematic” funds based on: Types of capital (flexible debt, equity etc.), Community focus (BIPOC, etc.), Thematic area: Food Systems, Flexible, low-cost capital

• Bring together like-minded funders for pooled investments

• Construct integrated capital portfolios in areas of interest, such as local food systems, place-based investing

• Learn through investment management and reporting

• Share lessons learned and promising practices

Our Process

Recirculating Capital for Greater Impact

An Impact Charitable, Donor-Advised Fund is the conduit for many different types of impact, made through many different types of tools.

Your funds are invested to generate positive social outcomes and financial return. You can then reinvest the same funds to achieve more positive change. Over and over and over again.

Featured Work

Bondadosa

During the COVID-19 pandemic, Bobdadosa fulfilled contracts to provide free nutritious meals and/or fresh produce through federal food programs...

Subscribe to Our Newsletter

Be the first to get our exclusive offers, latest news, updates, and events.