Our Work

We are a connector.

We work with local and national investors, donors, advisors, foundation staff and trustees, policymakers and community organizations who are closest to the problems we aim to fix. We leverage their expertise and create the conditions necessary for collective visioning and cross-sector collaboration.

Our Privilege to Partner

Companies, Organizations, Projects & Funds

- All

- Impact-First Investments

- Integrated Capital

- Economic Mobility Programs

- Program-Related Investments

Art for Redemption

Impact Charitable provided financing to set up an online marketplace for this Denver-based start-up so prisoners can sell their art. Investment from a group DAF with Rockies Venture Club…

B-Konnected

As part of the CABB investment portfolio, Impact Charitable made a $200,000 loan to B-Konnected to support their operations and growth. B-Konnected has been delivering…

Big Hogan

A Navajo owned and operated hospitality business located near the South Rim of the Grand Canyon. A DAF provided a $20,000 loan for 10 years at 2% to support business growth.

Black Farmer Fund

In June of 2023, Impact Charitable brought together six donor-advised funds to aggregate their investment into the Black Farmer Fund Reparative Note. These six funds…

Bondadosa

During the COVID-19 pandemic, Bobdadosa fulfilled contracts to provide free nutritious meals and/or fresh produce through federal food programs…

Bridge House

Bridge House helps adults experiencing homelessness gain access to resources they need for a better future. Participants in the Bridge House Ready to Work program…

Collective for the Advancement of BIPOC+ Business

As part of the CABB, Impact Charitable has created a special purpose fund to provide “Friends and Family” type capital to businesses to further the…

Clara Brown Commons

An affordable housing community serving low income families on property located in Denver needed capital to acquire and develop the complex. A $750,000 loan was…

Colorado Housing Accelerator Initiative

CHAI is a new investment fund to serve the gap between conventional housing subsidy programs and market rate housing. CHAI will create and preserve affordable housing…

Denver Basic Income Project

The Denver Basic Income Project is giving basic income to individuals experiencing homelessness with the goal of building a healthier society grounded in social justice and…

Capital of Communities Fund

The Capital for Communities Fund is an international impact investment fund that lends to microfinance institutions and credit cooperatives in Latin America…

Capital Sisters International / Sisterbond

In partnership with a donor-advised fund, Impact Charitable holds a $5,000 Sisterbond with Capital Sisters International. Their vision is a world…

Dope Mom Life

A creative content agency designed to cultivate relationships between organizations and multicultural communities through digital and video content. Dianne Myles started…

Fat and Sassy Goats

Fat and Sassy Goats was founded as a Public Benefit LLC in 2021 to introduce goat grazing services as an ecologically beneficial alternative to chemical and mechanical removal of…

Fibers Fund

Recognizing that natural fiber and dye crops can and should play a key role in vibrant, economically viable regenerative agriculture, SAFSF and Fibershed joined forces in 2022 to…

Hands of the Carpenter

Supporting single moms, HOC provides auto repair and maintenance at deeply discounted prices, and sells donated vehicles to women in the program. This social enterprise is expanding to a…

ICONI

As part of the CABB investment portfolio, Impact Charitable made a $150,000 Revenue-Based financing investment into ICONI. Founded in 2019 by military veteran and CEO…

Impacto

As part of the CABB investment portfolio, Impact Charitable made a $200,000 a Revenue-Based financing investment into Impacto. Impacto is a Denver-based early-stage company…

Infinite Focus/CLYMB

Infinite Focus Schools is a socio-emotional learning (SEL) software company. The software product shows results in effecting behavioral improvements and overall well-being…

Kyndhub

An online community that gamifies volunteering, intentional acts of kindness, gratitude and monetary giving. A DAF provided a $100,000 revenue share agreement to…

Left Behind Workers Fund

The Left Behind Workers Fund is a collaboration between community-based organizations, philanthropists and the public sector that was incubated by Impact Charitable…

Left Behind Workers Fund Rental Assistance

The Left Behind Workers Fund Rental Assistance program provided rental assistance to undocumented individuals in need of emergency rental support to avert evictions and keep…

Navajo Power

NP is creating economic engines on tribal lands that will benefit native communities and address climate change by converting the communities from coal to…

One Purse

As part of the CABB investment portfolio, Impact Charitable made a $200,000 SAFE investment into One Purse. Onepurse is a currency exchange platform for African…

Oweesta

Through a partnership with the Christensen Fund, Impact Charitable made a $1MM loan commitment to support the important lending programs of Oweesta.

Oweesta is the…

PharmaJet

Working with a long-time impact investor and supporter of Impact Charitable, we made a $30,000 investment into PharmaJet in their Series H round. PharmaJet is…

Sephora Accelerate

Sephora Accelerate is a brand incubation program dedicated to building a community of innovative, inspirational brand founders in beauty. With a focus on founders who are…

Sistahbiz Loan Fund

Sistahbiz Global Network (SGN) is a for-profit Denver-based coaching and mentoring platform for Black women entrepreneurs looking to launch and grow small businesses. According to…

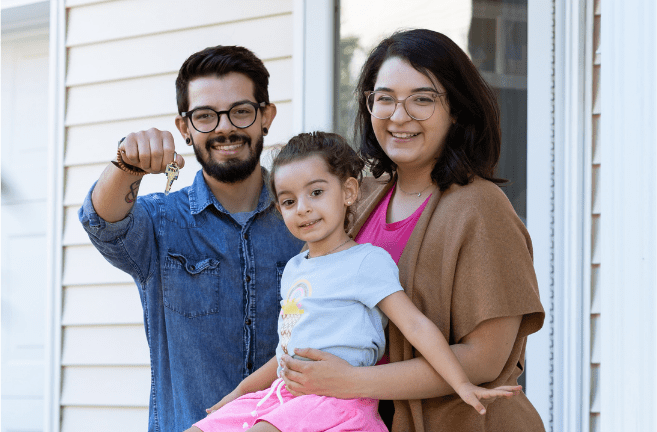

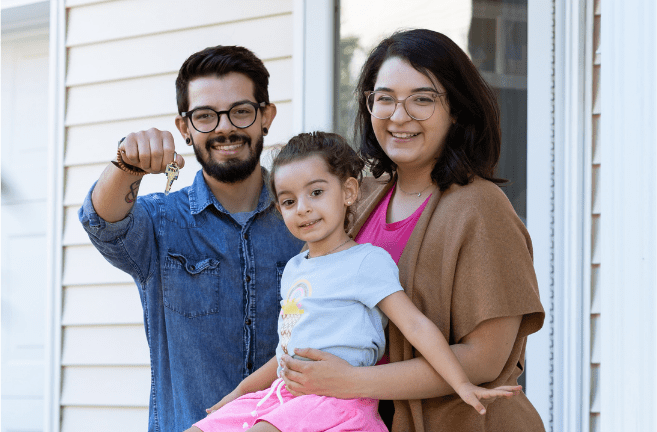

Tenant Equity Vehicle

Low- and moderate income renters – who are disproportionately BIPOC households and workers in many critical service occupations – lack equitable access to homeownership…

The Dearfield Fund for Black Wealth

The Dearfield Fund for Black Wealth is a public benefit limited liability company, with the goal of accelerating Black and African American wealth in the Denver Metro Area through…

Thriving Providers Project

Thriving Provider Project works with regional partners to provide direct cash payments to Family, Friend and Neighbor (FFN) caregivers and newly licensed Family Child Care (FCC)…

Tocabe

In partnership with Tocabe and the Christensen Fund, Impact Charitable has moved $800,000 in loans and grants to support Tocabe’s work to create a sustainable, authentic food…

Village Exchange Center

VEC partnered closely with Impact Charitable on the Left Behind Workers Fund to connect immigrants with the direct cash assistance needed to support these families…

Watson University

This DAF-funded Income Sharing Agreement with Watson Institute provides tuition to students seeking a three-year degree in social entrepreneurship. Students repay…

Worklife Partnership

Through a group DAF with Social Venture Partners, Impact Charitable invested in a Micro loan program (average loan <$1,000) serving low-income, front-line workers who are…

Art for Redemption

Impact Charitable provided financing to set up an online marketplace for this Denver-based start-up so prisoners can sell their art. Investment from a group DAF with Rockies Venture Club…

Big Hogan

A Navajo owned and operated hospitality business located near the South Rim of the Grand Canyon. A DAF provided a $20,000 loan for 10 years at 2% to support business growth.

Bridge House

Bridge House helps adults experiencing homelessness gain access to resources they need for a better future. Participants in the Bridge House Ready to Work program…

Capital of Communities Fund

The Capital for Communities Fund is an international impact investment fund that lends to microfinance institutions and credit cooperatives in Latin America…

Dope Mom Life

A creative content agency designed to cultivate relationships between organizations and multicultural communities through digital and video content. Dianne Myles started…

Infinite Focus/CLYMB

Infinite Focus Schools is a socio-emotional learning (SEL) software company. The software product shows results in effecting behavioral improvements and overall well-being…

Kyndhub

An online community that gamifies volunteering, intentional acts of kindness, gratitude and monetary giving. A DAF provided a $100,000 revenue share agreement to…

Navajo Power

NP is creating economic engines on tribal lands that will benefit native communities and address climate change by converting the communities from coal to…

Watson University

This DAF-funded Income Sharing Agreement with Watson Institute provides tuition to students seeking a three-year degree in social entrepreneurship. Students repay…

Worklife Partnership

Through a group DAF with Social Venture Partners, Impact Charitable invested in a Micro loan program (average loan <$1,000) serving low-income, front-line workers who are…

Collective for the Advancement of BIPOC+ Business

As part of the CABB, Impact Charitable has created a special purpose fund to provide “Friends and Family” type capital to businesses to further the…

Fat and Sassy Goats

Fat and Sassy Goats was founded as a Public Benefit LLC in 2021 to introduce goat grazing services as an ecologically beneficial alternative to chemical and mechanical removal of…

Sephora Accelerate

Sephora Accelerate is a brand incubation program dedicated to building a community of innovative, inspirational brand founders in beauty. With a focus on founders who are…

Denver Basic Income Project

The Denver Basic Income Project is giving basic income to individuals experiencing homelessness with the goal of building a healthier society grounded in social justice and…

Left Behind Workers Fund

The Left Behind Workers Fund Cash Assistance program provided direct cash payments of $1,000 to undocumented Colorado workers impacted by the COVID-19…

Left Behind Workers Fund Rental Assistance

The Left Behind Workers Fund Rental Assistance program provided rental assistance to undocumented individuals in need of emergency rental support to avert evictions and keep…

Tenant Equity Vehicle

Low- and moderate income renters – who are disproportionately BIPOC households and workers in many critical service occupations – lack equitable access to homeownership…

Thriving Providers Project

Thriving Provider Project works with regional partners to provide direct cash payments to Family, Friend and Neighbor (FFN) caregivers and newly licensed Family Child Care (FCC)…

Bondadosa

During the COVID-19 pandemic, Bobdadosa fulfilled contracts to provide free nutritious meals and/or fresh produce through federal food programs…

Clara Brown Commons

An affordable housing community serving low income families on property located in Denver needed capital to acquire and develop the complex. A $750,000 loan was…

Colorado Housing Accelerator Initiative

CHAI is a new investment fund to serve the gap between conventional housing subsidy programs and market rate housing. CHAI will create and preserve affordable housing…

Hands of the Carpenter

Supporting single moms, HOC provides auto repair and maintenance at deeply discounted prices, and sells donated vehicles to women in the program. This social enterprise is expanding to a…

Sistahbiz Loan Fund

Sistahbiz Global Network (SGN) is a for-profit Denver-based coaching and mentoring platform for Black women entrepreneurs looking to launch and grow small businesses. According to…

The Dearfield Fund for Black Wealth

The Dearfield Fund for Black Wealth is a public benefit limited liability company, with the goal of accelerating Black and African American wealth in the Denver Metro Area through…

CABB Partnership

Impact Charitable, an impact capital catalyst, is partnering with the New Community Transformation Fund - Denver

Subscribe to Our Newsletter

Be the first to get our exclusive offers, latest news, updates, and events.