Our Solutions

Program-Related Investment Services

We bring investors together to increase efficiency and move more capital into impact-first investments

Executive Overview

Program-Related Investments (PRIs) are a powerful way for foundations to provide funding to nonprofits and social enterprises working on innovative and market-informed approaches to solving social and environmental issues.

PRIs are a flexible financing tool that allow foundations to invest in solutions to social problems, while also recycling those dollars for new investments.

PRIs complement traditional grantmaking. PRIs can be particularly useful in helping scale a solution, kick-start a project, and sustain a social enterprise with new capital. Foundations can also use PRIs to help lower the risk for other investors, helping nonprofits and social enterprises attract additional capital and partners, and help unlock needed credit for non-profits.

Impact Charitable offers services to individual foundations to support PRIs as well as offering a PRI Aggregator product. For Foundations that are new to PRIs, or are not interested in creating the internal capacity to diligence, close, monitor and report on PRIs, the Impact Charitable team can lend their expertise in philanthropy and finance to make these investments efficiently and effectively.

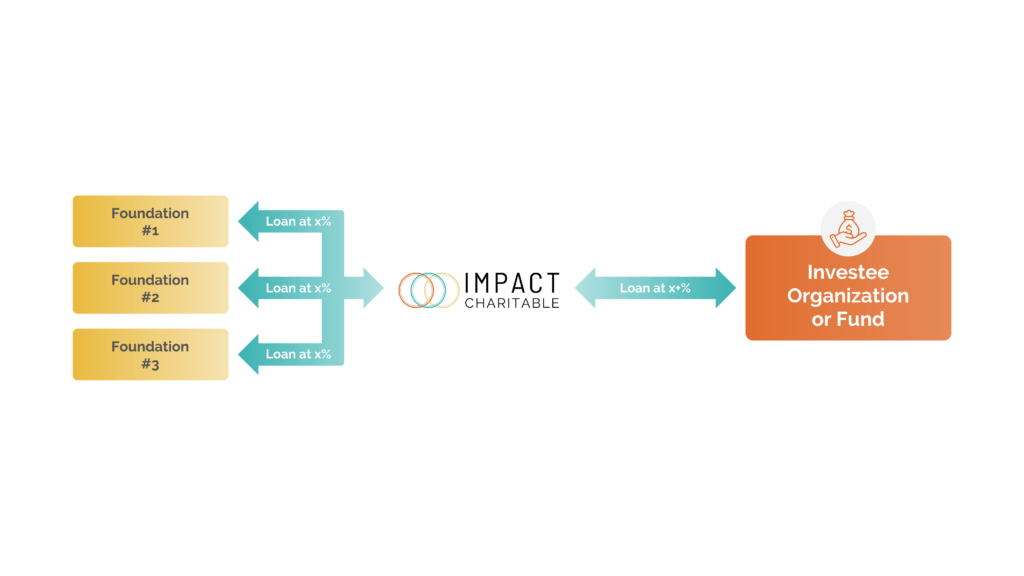

In many cases, bringing Foundations together to collaborate on PRIs can leverage time and money. Aggregating funds adds value for both the funders interested in making a program-related investment and for the entity/project raising capital. Foundations value the ability to lend to a 501c3 public charity with extensive experience in impact-first investing while the projects value the ability for Impact Charitable to aggregate multiple investors into a single investment. In addition to aggregating investment capital, Impact Charitable can provide reporting and loan administration utilizing efficient systems.

In the PRI Aggregator service, Impact Charitable acts as an intermediary between foundations and impact-first, mission-driven entities. The investing foundation makes a loan to Impact Charitable for the sole purpose of funding a particular investment or impact focus area. In the loan agreement between Impact Charitable and the Foundation, the investee or project is named as the designee for the funding. The investee has the benefit of funding to fulfill its mission and impact objectives while Impact Charitable manages the flow of capital.

Impact Charitable has provided the PRI aggregator service for loans to support real estate development projects, low-income housing funds, as well as equity investments in for-profit companies creating wealth in under-resourced communities.

Product Overview

For Foundations

• Coordinate efforts and create efficiencies - shared due diligence and legal processes

• Supplement internal capacity to make impact-first investments

• Reduces individual foundation risk by spreading an investment across multiple funders

For Community Organizations, Social Enterprises, Funds, and Ventures

• Minimize paperwork and reporting by having one investor

• Support with deal structuring and legal documents

• Accounting and compliance efficiency

Our Process

Featured Work

The Dearfield Fund for Black Wealth

The Dearfield Fund for Black Wealth is a public benefit limited liability company, with the goal of accelerating Black and African American wealth in the Denver Metro Area through...

Subscribe to Our Newsletter

Be the first to get our exclusive offers, latest news, updates, and events.