Venture capital, with its high stakes and competitive landscape, has long been a pivotal force in shaping the innovation economy. Yet, beneath its surface of success stories lies a complex web of challenges, particularly for underrepresented groups striving for equitable access to capital. These challenges, often rooted in systemic barriers and biases, hinder the full realization of a diverse and inclusive entrepreneurial ecosystem.

Impact Charitable is working to address access to capital and remove barriers that will move more money, in more ways, to more people and places. As part of the Collective for the Advancement of BIPOC+ Business (CABB), Impact Charitable created the CABB Friends and Family Fund to provide alternative capital to underrepresented entrepreneurs.

We sat down with Vanessa Otero, founder of Ad Fontes Media and a member of the CABB Friends and Family Fund Investment Committee at Impact Charitable, to discuss the nuanced approaches being undertaken to address these disparities. As Vanessa and others have identified, the traditional venture capital model, while effective for some, can be exclusionary and even exploitative, particularly for founders from underrepresented backgrounds who may not have the “friends and family” resources to tap into for initial funding.

Vanessa’s own transition from patent attorney to thriving entrepreneur underscores the critical need for innovative financing solutions that resonate with the unique experiences of underrepresented founders.

In a conversation with Vanessa Otero, a member of the CABB Investment Committee and founder of Ad Fontes Media, we discussed the strategies that Impact Charitable’s CABB Friends and Family Fund Investment Committee uses to foster economic growth and support underrepresented entrepreneurs. Operating at the intersection of venture capital, impact investing, and philanthropy, the committee stands out because of its commitment to alternative funding mechanisms and its mission-driven investment philosophy as well as the composition of the investment committee. The investment committee has a majority of members that are entrepreneurs of color themselves and have been on the journey to raise capital.

Vanessa highlighted the vibrant ecosystem in Colorado for supporting underrepresented founders and the importance of network and community in navigating the investment landscape.

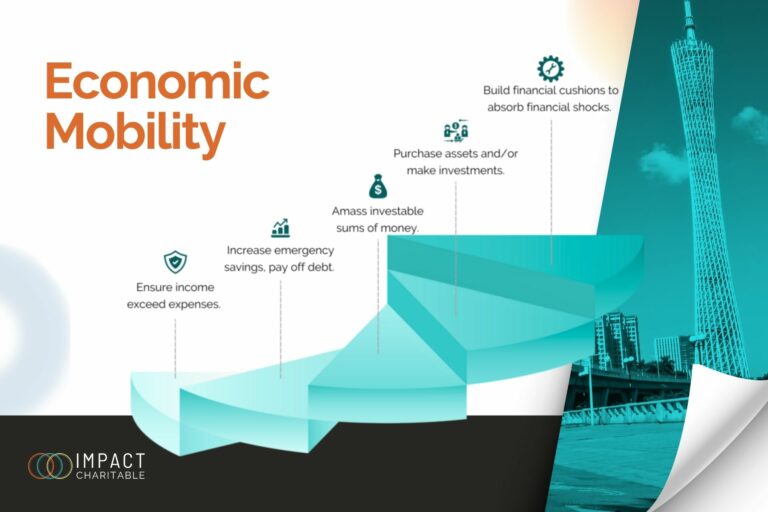

“I’m really passionate about the Friends and Family Fund because there’s such a need for alternative capital for the earliest stage underrepresented founders. Creating change for this population of entrepreneurs requires a different approach than traditional venture capital.” This fund aims to level the playing field by offering more equitable funding solutions, such as revenue-based financing and low-interest loans, that keep the founders’ best interests at the core.

By bringing her lived experience as an entrepreneur and her challenges in raising capital designed to support her success, she has been instrumental in shaping the investment review criteria, investments structures and future of the fund.

Vanessa explains, “a lot of venture capital is quite predatory to founders, if they can even get it at all. This fund is called the ‘Friends and Family Fund’ because idea-stage and pre-seed stage founders are often told to just “raise a few checks from friends and family,” which doesn’t work for those whose existing networks aren’t already wealthy. Impact Charitable has a unique structure that focuses on keeping the fund evergreen, enabling it to provide founder-favorable structures like revenue-based financing or low-interest loans.”

Expanding on this, Vanessa explained how Impact Charitable’s innovative funding approach is designed to support continuous reinvestment, “Often this funding is non-dilutive and highly likely to get repaid quickly by each funded company, which is great for founders while enabling the fund to redeploy capital to other companies. This is really different from traditional VC, which looks for exponential returns from a small percentage of funded companies. Impact Charitable’s approach is pretty rare and when I was looking for pre-seed funding, I didn’t see anything else out there like this.”

As the venture capital landscape continues to evolve, the imperative for inclusive and equitable access to capital grows stronger. The systemic barriers that have traditionally marginalized underrepresented entrepreneurs demand not just acknowledgment but actionable solutions. Impact Charitable, through its CABB Investment Committee, stands at the forefront of this transformative journey, leveraging its unique position at the nexus of venture capital, impact investing, and philanthropy to enact meaningful change.

Author: Cindy Willard

Cindy Willard is the Senior Director of Capital Activation at Impact Charitable, moving philanthropic funding to create more equitable access to capital.