So, what does it look like to unlock capital? At Impact Charitable, we answer that question in several ways from leveraging our expertise to re-imagining the tools and systems to promote the flow of more money to more people and places.

Our purpose at Impact Charitable is to help unlock and accelerate the flow of impact-first capital. We are proud to share that in 2023 we launched three brand new direct cash and guaranteed income programs and made twice as many investments last year as we did in 2022. By unlocking these dollars, we directly supported tens of thousands of people and hundreds of nonprofits, social enterprises, funds, and projects. (Look for our 2023 Impact Report coming in the first quarter of 2024.)

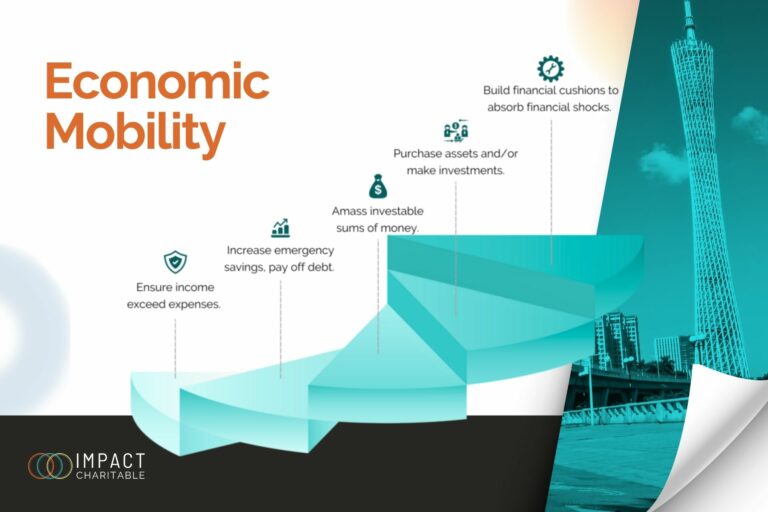

As the gap in funding widens, there is a growing need for philanthropic and governmental impact-first capital to bridge the divide, especially as “market rate” capital continues to overlook communities that have been historically underserved. That’s where this type of funding, sometimes called catalytic capital, and impact-first investing comes in. These are dollars that are specifically earmarked to have a positive impact on the community, distinguishing them from traditional models of financial return. Given that traditional grants are made with an expectation of achieving significant “impact” at the expense of financial return, a compelling case can be made to take a portion of those dollars (pre-committed to grants/the community) and invest in projects, ventures, and funds that offer significant impact at modest returns that allow for the project to flourish. In this scenario, a donor/investor can look at “any” level of return as a form of leverage since those dollars can be continuously reinvested and recycled into other grants or impact-first investments.

Identifying Barriers: The good news is that there are a growing number of individuals, foundations, family offices, and governmental entities who are interested in deploying their philanthropic capital in more unique, potentially leveraged ways. Unfortunately, even for those who desire to deploy their capital into impact-first investments, significant barriers remain.

- Lack of technical expertise for due diligence and structuring among capital providers.

- High transaction costs (relative to investment sizes)

- Structural barriers including legal constraints and access to ongoing investment management

- High Investment Minimums

How Impact Charitable helps unlock capital by removing these barriers

An experienced staff and professional services partners delivering a full spectrum of transaction and program design services. With decades of combined experience in private investments, impact investing, entrepreneurship, and philanthropy, Impact Charitable has deployed over $20 million across more than 36 investments using a wide range of structures (loans, equity-investments, revenue-based financing etc.) from early-stage ventures, affordable housing projects to impact-first investment funds. The breadth of our investments is in part based on our unique approach to due diligence. As an organization, we have adopted the Due Diligence 2.0 commitment that includes the question, “What is the risk of NOT investing in this project – for the community, the entrepreneur, the environment, and other stakeholders?” Visit our Insights page to read more about our due diligence process.

Aggregating capital and sharing transaction costs. Our role as an intermediary allows us to pool funds which then helps us to overcome investment minimum requirements and reduce overall transaction costs by spreading due diligence, underwriting, and legal costs across multiple investors. We have worked with multiple DAF (donor-advised fund) holders to direct more dollars to investments, and we have brought Foundations together to reduce the financial burden on the investee company. In some cases, we have brought together DAF dollars and PRI funds to create a unique opportunity to mobilize capital for catalytic investments.

Integrated Capital. Catalytic Capital Partners (a partnership with Mission Driven Finance or MDF). Mission Driven Finance is a social enterprise based in San Diego, California with deep experience in fund management, administration, and investment advisory services; we like to think of them as our for-profit sibling. In early 2023, Catalytic Capital Partners was established as a wholly-owned subsidiary of Impact Charitable that holds a growing number of investment funds managed by MDF. This structure provides investors and communities with the professional fund administration and investment services MDF clients are accustomed to while making it much easier, and more efficient to attract program-related investments and grant capital into these important fund vehicles. Projects currently housed in this structure include real estate for childcare providers, the initiative for inclusive entrepreneurship, and a fund supporting regenerative agriculture.

As we explore ways to unlock capital, we are constantly reminded of the critical role of innovative financial strategies in bridging the resource gap. Looking ahead, we are committed to deepening our impact and leveraging every dollar toward creating sustainable and positive change. Our journey continues as we challenge long-held beliefs and work to reimagine and recreate systems to support equitable growth across historically underserved communities.